| Plus... overdraft warning, BT hike, 20mths 0%, CLAIM pension credit  THE TOP TIPS IN THIS EMAIL

| | Is now the perfect time to buy a home or remortgage with stamp duty slashed & super-cheap mortgages? Yet it's never that simple...  A few words from Martin first (written on Fri before property tax changes were announced in Scot & Wales): "The Chancellor made a huge housing intervention last week, scrapping stamp duty (in Eng & NI) for properties up to £500,000. Nine in 10 purchasers won't pay a penny, and those who do will save £15,000. Plus UK interest rates are at a 325yr historic low, so mortgage rates are seriously cheap, meaning it's easy to think this is the moment to buy. A few words from Martin first (written on Fri before property tax changes were announced in Scot & Wales): "The Chancellor made a huge housing intervention last week, scrapping stamp duty (in Eng & NI) for properties up to £500,000. Nine in 10 purchasers won't pay a penny, and those who do will save £15,000. Plus UK interest rates are at a 325yr historic low, so mortgage rates are seriously cheap, meaning it's easy to think this is the moment to buy. "Yet life isn't binary. Mortgages are cheap, but you'll need good credit and affordability scores and a much bigger deposit or equity (15% with some lenders) to get one. And with a third of people struggling due to the pandemic, a UK-wide recession of unprecedented swiftness, and unemployment rocketing, that's not easy for all. "Then we need to remember that's just one of the reasons why the Chancellor intervened. The housing market faces a period of real uncertainty, and he wants to get it moving. The fact he feels intervention is needed raises a point of caution in itself. Plus of course, as the stamp duty rise is temporary, it could cause a demand bubble. "So what am I trying to tell you? Good question (if I say so myself). While it's almost certainly a good time to get a mortgage if you can, sadly only a crystal ball will tell you if it's a good time to buy or move. "So ensure the financials are sound, don't overstretch yourself, pick a budget and stick to it (even if that dream home is just a little bit more, stick to your budget). Buy a home you'd be happy to stay in for longer, as that's the best insurance possible. "I've actually taken the start of this week off, to recuperate after my TV series, so I wrote this on Friday. The team will take you through the key details (I really hope so or I'll look very silly)." To help navigate the mortgage maze, you can download PDFs of:

They incl fixes vs variables, LTV help, credit scoring tips, how to find a top deal & much more - lots of which is below, so without further ado... |  1) New. Use our updated Stamp Duty Calculator. When you buy land or a property you usually pay tax on it. While often referred to as stamp duty, that's the name in Eng & NI - it's different in Scot & Wales. In each case though, there are thresholds below which no duty is charged - and these have now been raised. Use our updated UK Stamp Duty Calculator to tell you what you'll pay and how it all works. Here are the key updates: 1) New. Use our updated Stamp Duty Calculator. When you buy land or a property you usually pay tax on it. While often referred to as stamp duty, that's the name in Eng & NI - it's different in Scot & Wales. In each case though, there are thresholds below which no duty is charged - and these have now been raised. Use our updated UK Stamp Duty Calculator to tell you what you'll pay and how it all works. Here are the key updates: - Eng & NI. From last Wed (8 Jul) till 31 Mar 2021, you'll pay NO stamp duty on the first £500,000 of the purchase price of a primary home.

- Scot. From today (Wed 15 Jul) till 31 Mar 2021, you'll pay no land & buildings transaction tax on the first £250,000 of the purchase price of a primary home.

- Wales. From 27 Jul till 31 Mar 2021, you'll pay no land transaction tax on the first £250,000 of the purchase price of a primary home. Given the way stamp duty is charged, the biggest saving is actually on pricier homes. Eg, in Eng & NI on a £600,000 home after the cut, as there's nothing to pay on the first £500,000, you just pay 5% of the amount over £500,000 - which is £5,000. Early last week, the total stamp duty in that case would've been £20,000. What matters in Eng & NI is the date you complete the purchase, so if you've exchanged contracts already but not yet completed, you'd pay the lower (or zero) stamp duty. We're still awaiting that exact info for Scot & Wales. Our Stamp Duty Calculator has more info on that and how it works for 2nd or additional homes. 2) You'll need a bigger deposit or more equity to get the best rates. When you apply for a mortgage, lenders offer a rate based on how much you borrow as a proportion of the property value (known as loan to value - LTV for short). The lower the LTV, the better the rate - see more on how LTVs work. Since coronavirus hit, the number of mortgage deals at higher LTVs - eg, 90-95% - has dramatically decreased. So you'll likely struggle to get a mortgage with a small deposit. According to data firm Moneyfacts, the number of 90% mortgages available has fallen since late Feb from 776 to just 70. This means first-time buyers will have to save harder to get on to the housing ladder (see below for tips on boosting your deposit). But those looking to move or remortgage should also look at using any spare savings to help bag a better deal, as mortgages get cheaper as you pass down LTV bands, as this table shows... | CHEAPEST 2yr fixes (based on £200,000 property) | | LTV | Rate | Monthly cost | Yearly cost | | 95% | 3.29% | £930 | £11,160 | | 90% | 2.19% | £780 | £9,360 | | 80% | 1.41% | £633 | £7,596 | | 75% | 1.14% | £575 | £6,900 | | 60% | 1.09% | £457 | £5,484 | | Based on current lowest purchase rates, excl fees, over 25yr total term. |

3) Compare to find the cheapest deals, incl 1.09% 2yr fix. While not quite at all-time lows, rates are still seriously cheap. Yet always check what your existing lender can offer you first, as it may have lower fees. Then use our mortgage comparison tool as a benchmark to see what's out there in the wider market - here are a few examples below. But don't take these as gospel. The key is what you'll be accepted for, as lenders' criteria are tight and not everyone qualifies for every mortgage (we've help on acceptance below). Current BEST-BUY mortgagE RATES

Rates on £200,000 mortgages | | TYPE, INTRO PERIOD + LTV | INTRO RATE + FEES | COST/YR (1) incl fees | | Typical standard variable rate for comparison (which you're most likely on if you're not on an introductory deal) | 3.59% | £12,132 | | 2yr fix at 90% | 2.19% - no fee | £10,400 | | 2yr fix at 60% | 1.14% + £2,034 | £10,100 | | 5yr fix at 90% | 2.49% - no fee | £10,760 | | 5yr fix at 60% | 1.42% + £1,525 | £9,800 | | 2yr tracker at 60% | 1.26% + £1,034 | £9,850 | | 2yr tracker at 80% | 1.59% + £995 | £10,110 | | (1) Cost per year during intro period, eg, 2yrs on a 2yr fix, incl all fees. Assumes 25yr total mortgage term. |

4) It isn't just about the best deal, it's about getting accepted too. There are a couple of possible hurdles, incl: - A rotten credit report can torpedo a home loan application. So double-check your credit file for FREE. - Lenders must also obey strict rules to check if you can afford mortgage repayments - not just at current rates, but if they rocketed to 7-8%. They want evidence of income, bills, expenses and sometimes even eating out. So being frugal now will help.

Note that the financial impact of the pandemic could mean acceptance has already become harder for some and could get worse yet.  5) Brokers can help find the best deal for you. It can be difficult to know which lender will accept you, which is why we suggest you use a broker. They can help cut through the complexity, particularly with the mortgage market in a state of flux, and give you access to extra deals not available to the public. 5) Brokers can help find the best deal for you. It can be difficult to know which lender will accept you, which is why we suggest you use a broker. They can help cut through the complexity, particularly with the mortgage market in a state of flux, and give you access to extra deals not available to the public. Brokers can also help if you've unusual circumstances, eg, you've more than one mortgage, you're buying an unusual property or you're self-employed. See our Top Mortgage Brokers guide. 6) First-time buyer but don't have a big enough deposit? What to try. If you're looking to claw your way on to the ladder, then you'll need to save up and save hard - especially if you want to take advantage of the temporary stamp duty cut before it expires next Apr. Try... - Buying longer-term? Get a Lifetime ISA - and there's a trick to get a 25% boost with NO CATCH. Anyone aged 18-39 can open a LISA and get a 25% boost, worth up to £1,000/yr, on saving towards a first home that costs less than £450,000. The LISA must have been open a year to get the boost, so it's too late to do this if you're hoping to buy before the stamp duty cut ends next Apr - this is about buying longer-term. If you've already got a LISA, try to max out this year's allowance for the full bonus. Normally, the big worry with LISAs is if you don't use it to buy a home, you must keep the money saved until you're 60, or pay a 6.25% penalty to withdraw it before. Yet right now the rules have been relaxed due to coronavirus - withdrawals are penalty-free until 5 Apr 2021. So you can open one now, and if it's not right for you, withdraw by then with no penalty. FULL explanation & info in Top Lifetime ISAs. - Speak to family and friends for help. There's no harm in asking. Even if you can scrape 5% together yourself, if family can bump you up to 10% you'd get a better rate and more choice of mortgages. - Ask your parents to be guarantors. Some of the few 95% deals around are 'guarantor mortgages', which take parental income into account as well as their offspring's income. This can help you get a bigger mortgage as it's worked out on a higher income - but if you can't pay it, your parents'll be on the hook. - Apply for Govt help. There's a rapidly-closing window to get Help to Buy equity loans - that help you build a bigger deposit when buying some new-build properties - before the scheme is watered down next Apr. We're working rapidly on a revamped Help to Buy Equity Loans guide, but for now, see the Gov.uk site for more help. 7) Got a mortgage already? Get to know your current deal to help you save by remortgaging. It's wise to understand how it works to see if it's worth switching, so it's important to know: a) What's the rate? Plus monthly payments & outstanding debt.

b) What type is it? Is it a fix, tracker, SVR etc? See fixes vs variables.

c) When's the intro deal over? Eg, when does the 2yr fix end?

d) When must it all be repaid? Eg, in 10, 20, 25yrs?

e) Will I be penalised to switch? Any early repayment/exit penalties?

f) What's the LTV? As explained above. 8) Midway through your mortgage? It could pay to ditch your fix, especially with rates so low. Use our Ditch your fix? tool to see if you can save by switching from a pricey fix. It won't work for all, as some will face exorbitant early repayment fees - but with rates so low, why not check just in case? 9) Want to remortgage and stuck on a low LTV? Speak to your lender. If you're trying to remortgage and struggling to get a deal with another lender - either because your LTV's too low or you're struggling to meet strict borrowing criteria (eg, if you're on furlough or have been made redundant), try speaking to your existing lender. It may be able to do a product transfer, eg, some offer a 95% mortgage to existing but not new custs. Yet we need to be clear here - not all lenders will help. We've long been campaigning to help 'mortgage prisoners' - those who are trapped on expensive mortgages because they don't meet the borrowing criteria for a cheaper deal. Sadly, the pandemic is likely to have created many more prisoners. We'll continue to highlight the problem and fight to help - but ultimately this is a problem that politicians need to fix. If you think you're affected, you can join the UK Mortgage Prisoners campaign group. 10) Can I afford it? What will it cost? We've 8 calcs to help you further. They are...

Basic Mortgage Calc | Compare Two Mortgages | Mortgage Overpay Calc | Compare Fixed Mortgages | Ditch Your Fix | Saving For Deposit | How Much Can I Borrow? PS: Struggling to pay your mortgage? Don't panic. The first port of call is always to speak to your lender to see what help's available - including 3mth mortgage payment holidays. For other help available, see our Mortgage Arrears guide. | | DON'T believe the fake 'Martin Lewis' or 'MSE' ads

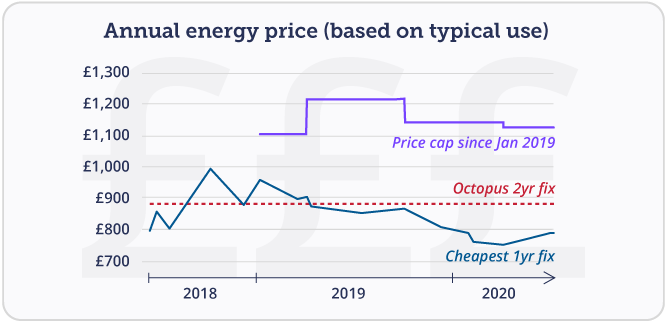

Lots of scam ads litter social media and even newspaper websites - some of these lie that we or Martin promote Bitcoin, binary trading etc. See Fake ads warning. | The MSE Big Energy Switch 15 Cheaper than the cheapest - 1yr fix, 2yr fix & prepay energy deals. Save £340/yr and bag what could be the last ultra-low rates for a while Important. Hurry as one hot deal has already gone, with dwindling availability on the cheapest 1yr fix  It's week two of our Big Energy Switch 15, where we use the weight of our huge user base to bag tariffs that undercut the market. Yet one of our four hot deals has already sold out (the top service fix from So Energy), while there are only 9,000 switches left for the cheapest 1yr fix - also the market's cheapest overall - though we will push for more. The event comes at a crucial time, as prices are rising from near-3yr lows. These low rates were a knock-on effect of the coronavirus-fuelled oil price slump, but as the tide has turned a bit, there's a risk we may not see similar lows any time soon (though nothing's certain). Check NOW if you can save - especially if you're one of the 11m overpaying on a standard tariff. It's week two of our Big Energy Switch 15, where we use the weight of our huge user base to bag tariffs that undercut the market. Yet one of our four hot deals has already sold out (the top service fix from So Energy), while there are only 9,000 switches left for the cheapest 1yr fix - also the market's cheapest overall - though we will push for more. The event comes at a crucial time, as prices are rising from near-3yr lows. These low rates were a knock-on effect of the coronavirus-fuelled oil price slump, but as the tide has turned a bit, there's a risk we may not see similar lows any time soon (though nothing's certain). Check NOW if you can save - especially if you're one of the 11m overpaying on a standard tariff. Links take you via our Cheap Energy Club to see how deals compare - crucial, as your winner depends on location and use. You can also play with filters to find your best, eg, 3 star+ service only. M ost Eng, Scot & Wales tariffs cost close to the regulator's PRICE CAP - currently an avg £1,127/yr on typical dual-fuel use. Prices/savings are based on that. - CHEAPEST 1YR FIX: Pure Planet - £787/yr on typical use. Min 9,000 avail. Green: 100% elec & offset gas. Service rating: 3.9/5 (good). Save: £340/yr. The Pure Planet 100% Green 12m Fixed Jul20 v1 online-only deal for new dual-fuel custs is a version of its already-cheap standard fix, but you get an extra £30 bill credit and the usual £25 MSE cashback, so it's £55 cheaper. Factor this in and on avg it's GB's cheapest fix on typical use. Pure is a mid-sized firm with 130,000 custs - and while it already has a good customer service rating, we've arranged 'MSE enhanced service' for this deal, so we can escalate issues directly. Plus when we've done deals with Pure before, they've gone well.

- CHEAPEST 2YR FIX: Octopus Energy - £883/yr on typical use. Green: 100% elec. Service rating: 4.2/5 (great). Save: £488/yr over 2yrs. This Exclusive Octopus 24M Fixed July 2020 v1 tariff is for new dual-fuel and elec-only custs, available until Fri 24 Jul. Octopus has a great customer service feedback rating, and it's catching up with the Big 6 in size, with well over 1m custs. While for typical use it's about £100/yr more expensive than the cheapest 1yr fix, the rate is locked in until Jul 2022, giving two winters' certainty. As the graph shows, Octopus's price would've been the market's cheapest fix for good chunks of the last few years. So if prices rise a lot, it may look very cheap.

- CHEAPEST PREPAYMENT TARIFF: Bulb - £963/yr on typical use. Green: 100% elec & offset gas. Service rating: 4.1/5 (great). Save: £201/yr. This MSE Bulb Vari-Fair Prepay for new dual-fuel & elec-only prepay custs is available until Fri 24 Jul. Bulb is one of the biggest firms outside the Big 6, with great customer service feedback. It's a version of its standard variable tariff, which is already competitive, but we've arranged that new custs get an extra £10 dual-fuel cashback on top of the usual £25 MSE dual-fuel cashback, meaning it's £35 cheaper (£17.50 elec-only). Like most prepay tariffs, this is variable so the price can move, though you can leave penalty-free if it gets pricey. However, Bulb has consistently been near the low end of the market.

| 'Eat out to help out' 50% off in Aug - who's in (eg, BK, Nando's are) & can you use a vch on top? The Govt said last week it'll finance 50% off meals out on Mon-Wed in Aug, up to £10 a head. At the time we didn't know which outlets would take part, but we're now getting a fuller taste. See 50% off restaurants latest. Top interest-free credit card for spending - M&S Bank 20mths 0%. If you NEED to borrow for a planned, affordable buy (eg, a new fridge), a 0% spending card is the cheapest way as there's no interest - but it's not an excuse to overspend. With 0% lengths shrinking, we're reminding you of the current top pick as we don't know how long it'll last. That standout is M&S Bank's 20mths 0% deal, plus it pays one point (worth 1p) per £1 spent at M&S or £5 elsewhere (19.9% rep APR). Always pay at least the min monthly payment, clear or transfer the debt before the 0% ends and don't bust your credit limit. Full help and more options in 0% Spending Cards (APR Examples). Ends today (Wed). 5GB/mth data + unlmtd mins & texts Sim - '£7/mth' from BT's Plusnet. MSE Blagged. Until 11.59pm, newbies to Plusnet* (uses EE's network) pay £9/mth, but as you're automatically sent a £25 prepaid Mastercard - almost as good as cash - factor that in and over the 1yr contract it's equiv to £6.92/mth. More help and deals in Top Sims. 15 Ikea hacks - as it launches its summer sale. Save time and money, incl 'try before you buy', free missing parts and the best deals in the sale. Ikea hacks Updated. 13 cycling MoneySaving tips - incl free repairs for key workers, cheap kids' rentals & workplace discounts. With popularity rising, we've added to our MoneySaving for cyclists tips. BT hiking bills for 1.3m landline customers by up to £54/yr. See who's affected & how to beat the hike. | 'I stopped being lazy and saved £500 on my car insurance. Thanks' You too could save £100s with our tried-and-tested system - and everyone should check, even if not at renewal Marilyn used to commit the mega MoneySaving sin of just auto-renewing her car insurance... until this year, when she followed our tips, as she gleefully emailed last week: "I've renewed automatically in the past as I got lazy (sorry). When a quote for £895 arrived, I knew I needed to shape up. So I went on a comparison site and got it for £394, saving £501 - how is that even possible? Thank you so much. Energy next." While her tale is inspirational if your policy is about to end, you don't always have to be at renewal to save, as we explain. Our Cheap Car Insurance guide has full help - here are the key steps to jumpstart your saving... (PS: If you're reading this Marilyn, scroll up to save on energy too.) -

Step 1. NEVER just auto-renew - instead combine comparisons to scour 100s of insurers in mins. The cheapest time to search is about three weeks before you need the insurance to start, so use your renewal quote as a reminder to check. But comparison sites don't search identical insurers, nor give identical prices, so try as many as you've time for in this order: MoneySupermarket*, Confused.com*, Compare The Market*, Gocompare*. (Why? See comparison order.) Step 1. NEVER just auto-renew - instead combine comparisons to scour 100s of insurers in mins. The cheapest time to search is about three weeks before you need the insurance to start, so use your renewal quote as a reminder to check. But comparison sites don't search identical insurers, nor give identical prices, so try as many as you've time for in this order: MoneySupermarket*, Confused.com*, Compare The Market*, Gocompare*. (Why? See comparison order.)

- Not at renewal? Can you also save £100s? If you find cheaper cover, as long as you've not claimed you can often cancel your policy for a pro-rata refund - minus a £50ish fee, which is waived for some in financial hardship. Even if charged it could be worth paying for the saving, although you won't get that year's no-claims discount - see full switching mid-policy help. This tip can work at any time if you're overpaying, but it's especially useful now as prices have fallen a tad in recent months so new deals could be even cheaper.

- Step 2. Check if special promo deals not on comparison sites win, eg, £60 Amazon vch. We've blagged two offers if you've one car - a £60 Amazon vch from LV* and a £60 Amazon, Love2Shop or M&S vch from Admiral*. Plus, if you've 2+ cars, we've also blagged this £75 Amazon vch deal from LV Multicar* and this £70 Amazon, Love2Shop or M&S vch from Admiral MultiCar*. There are more avail - see all car insurance promo deals. Note, it can take 120 days for vchs to arrive.

- Step 3. Then check big insurers not listed on comparison sites. You won't find Aviva* and Direct Line* on them, and they're worth checking as they can be competitive for some.

- Also check if these tips & tricks help you save...

- Use trial & error to see if comprehensive is cheaper than 3rd party.

- See if legitimately tweaking your job description cuts costs.

- Once you've found your cheapest insurer, it's worth checking if you can get cashback on it.

- Do policies always cover me? No. Insurance protects against the unexpected. So check the details, check insurers are regulated by the Financial Conduct Authority, and if a claim is unfairly rejected, take 'em to the free Financial Ombudsman.

PS: This is about cheap new cover, but if you're struggling due to coronavirus, you can ask your insurer if you'll save by reducing cover, eg, if your mileage has dived. If struggling to pay a monthly policy, some offer 1-3mth payment holidays. | 40% overdrafts are back (for some). See what your bank's doing and what to do . Selfridges up to 60% off sale incl clothing, bags and beauty, eg, £225 Michael Kors bag for £145. Not exactly MoneySaving, but it includes rare designer discounts, so if you're going to buy anyway, cut the cost. Selfridges sale FitFlop 20% off incl sale items, eg, £70 sandals for £22ish. MSE Blagged. Good for summer, ends Sun. Shoe-purb £50 Ciaté nail polish for £20 delivered. MSE Blagged. Five full-size gel-effect pots. 1,500 avail. Nail polish Holland & Barrett 25% off EVERYTHING code incl free delivery. MSE Blagged. Can be used with other offers, eg, half-price sale. Ends Fri. Holland & Barrett | Tell your friends about us They can get this email free every week | Warning. Only those who get pension credit can bag a free TV licence from Aug, but 1m+ families who fail to claim may also miss out on £1,000s in council tax discounts, free dental care etc. PLS SPREAD WORD

From 1 Aug, free TV licences for over-75s will only be available to households where someone gets pension credit - just being eligible isn't enough. But despite us nagging for years, 1m+ of the UK's poorest families fail to claim the benefit due to a lack of info, or perhaps pride. Yet it can be worth £1,000s in its own right, plus it opens a gateway to free TV licences and much more. Full help in our Pension Credit guide, here's the lowdown... From 1 Aug, free TV licences for over-75s will only be available to households where someone gets pension credit - just being eligible isn't enough. But despite us nagging for years, 1m+ of the UK's poorest families fail to claim the benefit due to a lack of info, or perhaps pride. Yet it can be worth £1,000s in its own right, plus it opens a gateway to free TV licences and much more. Full help in our Pension Credit guide, here's the lowdown... PLEASE SPREAD THE WORD - many who are eligible won't see this, so if you know someone you think could claim, tell 'em. - 1m+ families miss out on pension credit worth £3,000/yr on average - who's entitled to claim it? If you're over state pension age, live in the UK, and earn less than £173.75/wk as a single person or £265.20/wk as a couple - including pensions, savings income and work - then pension credit tops up your income to those amounts. If you've some savings, you could get a separate sum on top. See who's entitled to pension credit for full help.

Note: If you've been financially impacted by coronavirus, you may be entitled to claim where previously you weren't, or you could get more, but either way you must act. Use the link above for full help on what to do.

- Pension credit is also a gateway to TV licences and MUCH MORE. Most of these extras are for those who get the main element of pension credit, rather than those who only get savings credit. See what extras you're entitled to with pension credit, but to whet your appetite...

- Free TV licence for over-75s (from 1 Aug) - worth up to £157.50/yr.

- Council tax reduction - worth about £1,000/yr typically.

- Cold weather payments - worth £25/wk when it's really cold.

- Warm home discount - worth £140/yr.

- Free dental care - worth £100s/yr for some.

- Voucher for glasses/contact lenses - worth £39-£215 a time depending on your prescription.

- Housing benefit - could be worth £1,000s/yr.

- Importantly, pension credit is not automatic so you MUST claim it - here's how. You can apply via Gov.uk if you've already claimed your state pension, but otherwise you'll need to phone the Pension Service on 0800 99 1234 (or the NI Pension Centre on 0808 100 6165). They will fill in the form for you, though you can also request it to be posted to you, whether for yourself or someone else.

| SUCCESS OF THE WEEK:

"Hi Martin, I would like to say a big thank you. I've been working hard to get my credit score from very poor to nearly good. I've finally been accepted for a 0% balance transfer credit card . I currently pay £85/mth interest - what a saving."

(Send us yours on this or any topic.) | THIS WEEK'S POLL How have your monthly outgoings changed during lockdown? The UK lockdown has caused a big shift in spending patterns for millions of households. How have yours changed? Tesco Clubcard is the loyalty scheme which is most popular with MoneySavers. Last week, we asked which loyalty schemes you are signed up to, and how often you use them. More than 8,000 people responded, and Tesco's Clubcard proved to be most popular, with 82% of respondents signed up to it and 61% of those using it frequently (more than any other). Second for sign-ups was Boots' Advantage Card - 79% of respondents have one, though only 40% use it frequently. See full loyalty scheme poll results. | Ikea - 'Up to 50% off' sale and 15 more Ikea hacks

Selfridges - Up to 60% off sale incl clothing, bags & beauty

FitFlop - 20% off incl sale items

Ciaté - £50 nail polish set for £20 delivered

Holland & Barrett - 25% off everything & free delivery | PlayStation Plus - 'Free' games incl NBA 2K20, Tomb Raider

No7 - £130 of beauty and skincare for £32

Clarks - Up to 60% off selected shoes

Glasses Direct - Two pairs of designer prescription specs for £29

Amex - Free £5 cashback on a £10+ spend at local shops | | MARTIN'S APPEARANCES (WED 15 JUL ONWARDS) Thu 16 Jul - This Morning, ITV, 10.50am

Mon 20 Jul - This Morning, ITV, 10.55am

Mon 20 Jul - BBC Radio 5 Live, Ask Martin Lewis, 12.20pm MSE TEAM APPEARANCES (SUBJECTS TBC) Mon 20 Jul - BBC Radio Manchester, Drive with Phil Trow, from 2.25pm

Tue 21 Jul - BBC Radio Cambridgeshire, Lunchtime Live with Jeremy Sallis, from 12.25pm | 'I BAGGED AN 18CT GOLD BRACELET FOR 30P': YOUR TOP CHARITY SHOP FINDS That's it for this week, but before we go... with charity shops starting to open again after lockdown, you've been sharing the pick of the gems you've found rummaging around stores. Dolce & Gabbana trousers for £1, a men's Versace coat for £2 and a nearly new Barbour jacket for £10 were the pick of the clothing bargains, while the overall highlight has to be the MoneySaver who found an 18ct gold bracelet for 30p in a basket full of kids' costume jewellery. Let us know your best charity shop bargains in our #SecondhandSavers Instagram post. We hope you save some money, stay safe,

The MSE team | |

Comments

Post a Comment